-

Warning Signs

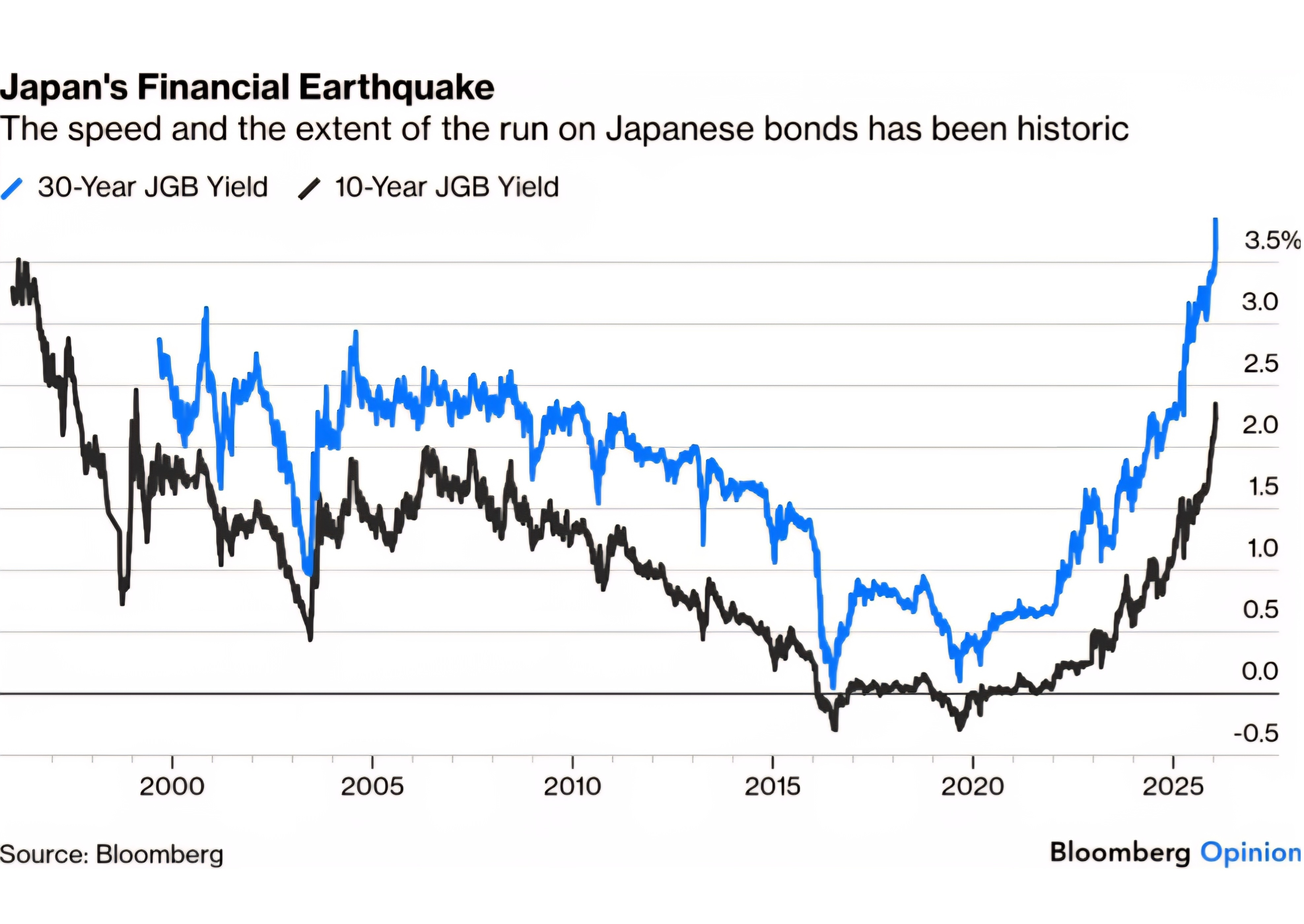

Financial Warning Signs are Flashing “We are in the midst of a rupture, not a transition… The old order is not coming back.” – Canadian PM Mark Carney War, Japanese debt yields, Yen intervention, Gold and precious metals soring, comments at the World Economic Forum. Warnings are flashing across the board. Yet, US Equities are at…