Roundtable Discussion

Another bank has failed.

Republic Bank had about $6 billion in total assets and $4 billion in total deposits, as of Jan. 31, 2024. The FDIC estimates that the cost to the Deposit Insurance Fund related to the failure of Republic Bank will be $667 million.

Why does this keep happening?

What does it portend for the system as a whole?

Now also…

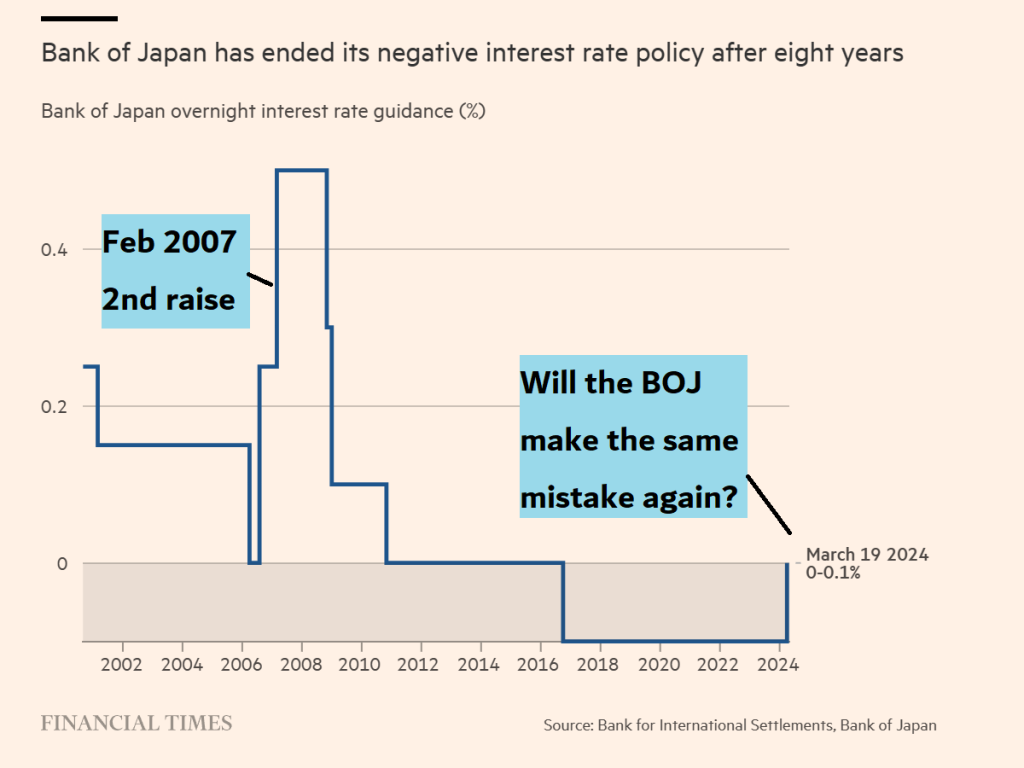

What’s going on with the Yen? It hit its lowest point in 34 years this past week. Many speculate the Japanese government had enough and intervened early Monday, aggressively buying Yen. Since they don’t announce their movement in Yen, it remains murky. Some believe the government is signaling a ceiling of 160 Yen/Dollar.

Why is this happening?

It has to do with the policy of the BOJ which may be poised to raise rates from 0% in the near future and that the Federal Reserve is now no longer planning to cut rates from 5.25%. The yield difference creates tension and downward pressure on the value of Yen/Dollar.

Watch CNBC video on US Japan yield differential causing Yen weakness

Why is this a problem?

As in 2007, if the BOJ raises rates or the Japanese government makes decisions based on pride rather than sound policy, it could trigger another global asset value crisis (2008 was a collapse in mortgage-related debt value). See more below.Relevant Articles

Regulators Seize Republic First – NYT Article

BOJ Intervenes Monday – WSJ Article

Background Discussions

Banking System Risks – April 2024

Bank of Japan (BOJ) raises raises rates for first time in 15 years – March 2024Prophetic Perspectives

1. First Republic failed and now Republic First fails. Coincidence?

How about this? When we put our “Republic” first – ie ahead of God and what Jesus said about true religion – are we in danger of failing? Similar to the phrase “America First”. Mmm…

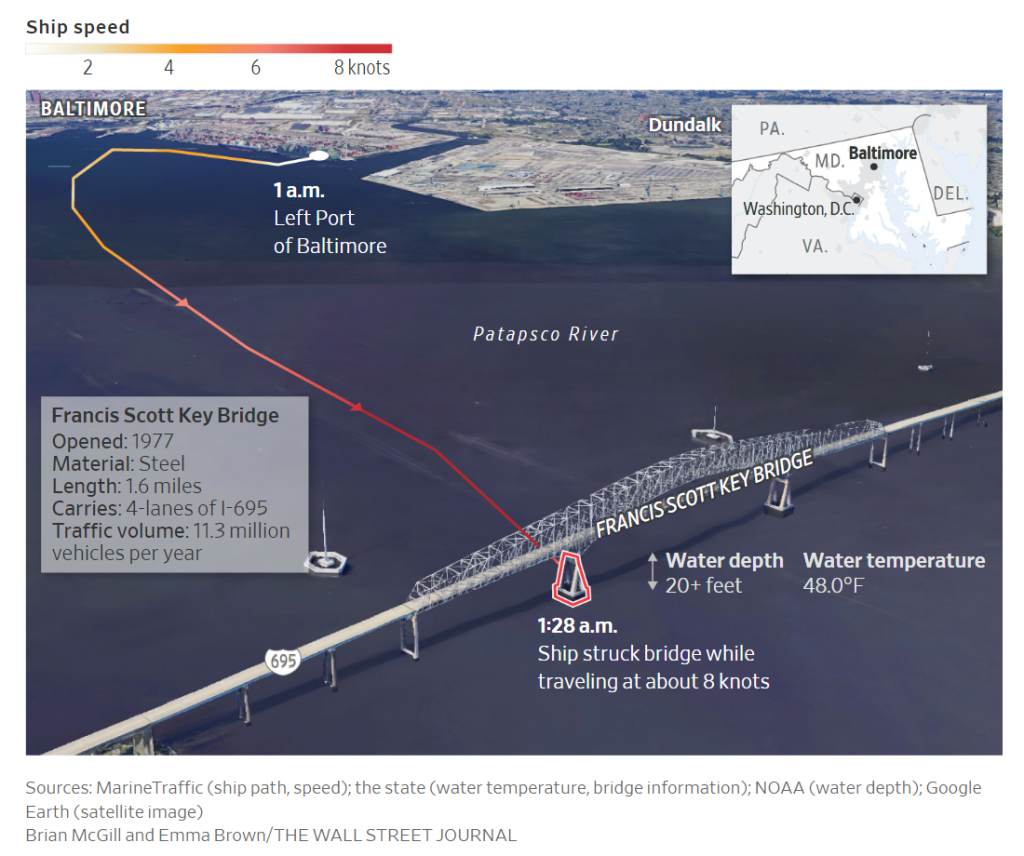

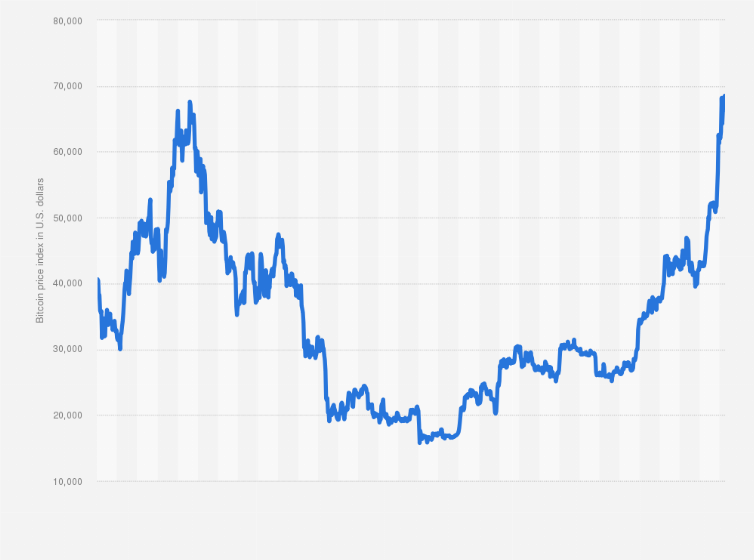

2. Government of Japan makes aggressive Yen intervention move to hit carry trade based on national pride in Japan and to protect the Yen. This is a very similar dynamic we saw in the beginning of 2007 and portends the danger of another financial crisis we saw in 2008/9.

“It is difficult to ignore the bad effects that these violent and abnormal movements [in currencies] will cause for the nation’s economy”

– Masato Kanda, finance ministry’s top currency official

Yen stats:

– 11% drop against dollar since beginning of year

– Volatility over the weekend of 2% swings highly unusual for major currency

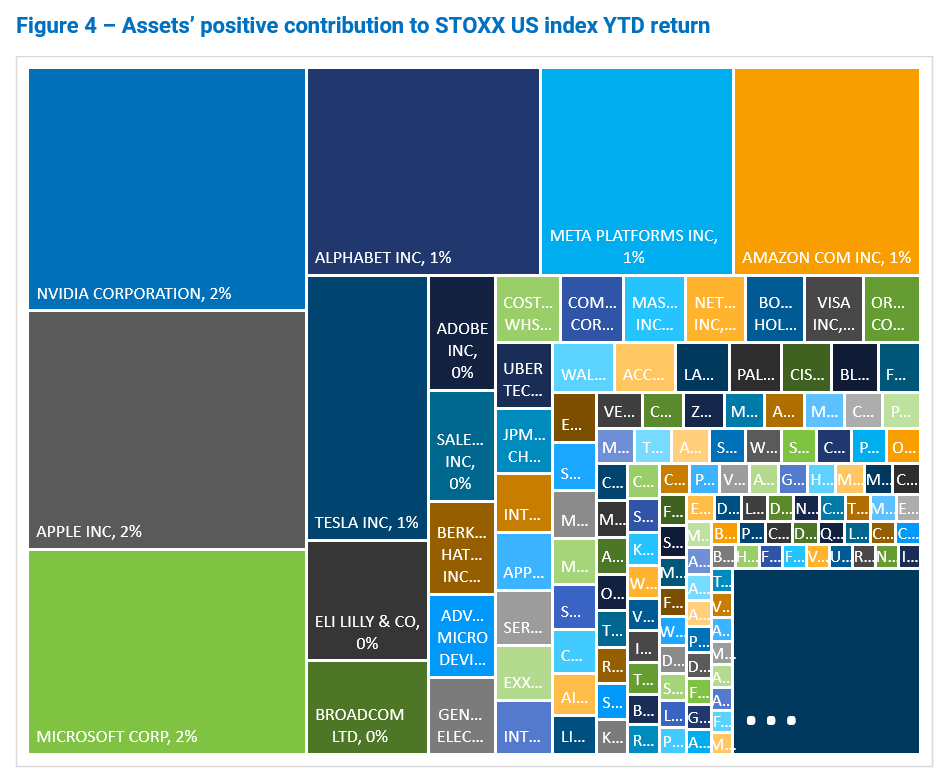

3. Commodity prices are starting to take off again

Like the Yen BOJ issue, the recent price spikes in all commodities is very similar to what we saw in 2008. Additionally, inflation is not cooling as expected. It remains stubbornly high (4%) vs. the planned inflation of the Fed (2%). One reason for this is housing remains at an near all time high both for purchase and for rent.

Source: IMF Primary Commodity Prices. Note: 2016=100

4. Housing prices remain at all-time highs both in rental rates and price

WSJ: Wall Street has spent billions buying homes

WHAT TO DO?

We talk about solutions.

We talk about the Storehouse strategy.

We also talk about practical preparation steps you can take (lending as investment, cash, metals, land).