Background Discussions:

Banking Crisis March 2023

Banking Crisis Over? May 2023

Pennies on the Dollar? August 2023

Roundtable Discussion

Important Terms to Understand

– Federal Reserve System aka “The Fed” – Was commissioned by Congress in 1913. The Fed acts as the US “Central Bank”, but does its operations via 12 regional Fed Reserve banks. Run by the “Board of Governors”, who’s members are appointed by the President and confirmed by the Senate.

– Federal Reserve Banks – 12 private regional banks (not part of the US government) that is owned by its member banks. All US Treasury (part of the US Government) activity that relates to printing and coining money, does so as “Federal Reserve Notes” (a debt instrument). Regulates US Commercial banks, but also secondarily regulates all other banks, thrifts, or credit unions, whether state or federally chartered. Any depository institution is ultimately regulated by “The Fed”.

– FDIC – Federal Depository Insurance Corporation (US Government Corporation) established as part of Glass-Stegal act of 1933

– NCUA – National Credit Union Association – regulates Federal Credit Unions (US Government entity)

– NCUIF – National Credit Union Insurance Fund – like the FDIC for credit unions

– Credit Union – “affinity” banks that are either State or Federally regulated and are member owned (cooperatives)

– State Chartered Bank

– Thrift / Savings and Loan – mortgage banks regulated through the OCC

– OCC – Office of the Comptroller of the Currency (part of UST that regulates banks)

– OTS – Office of Thrift Supervision (government agency regulating thrifts)

– Non-Banks – Finance companies that loan money usually funded through the capital markets (Wall Street) and are not regulated as banks because they do not take deposits which are insured

– Insured deposits – all deposits of traditional banks are insured through one agency or another

– Loan underwriting standards – all loans of traditional banks must be written according to the underwriting standards of the banks regulator, ultimately the Fed

***Key takeaway – any “bank” in the US that takes deposits, and separately makes loans based on its own decisions is ultimately regulated under The Federal Reserve System, whether directly or indirectly.

Current risks to the US Banking System

– The inherent 10-1 leverage built into our fractional reserve banking system means that if the value of the bank’s loan portfolio goes down by roughly 10%, the bank becomes insolvent.

– Commercial lending exposure to commercial real estate. CRE has steeply declined in value since offices became less occupied during and post COVID-19 with the work-at-home and work-remote trend. While some returning to the office has lessened vacancy rates, there has been an unforeseen step-wise change in demand, which has not snapped back, which now has put loans made to various office buildings at risk of default post any further governmental COVID relief/stimulus monies. Read article here: Mezzanine Lending – Commercial Real Estate in Trouble and here: US Commercial Real Estate Weakness

– Electronic transfers causing runs on the banks – See Fed Now discussion and Banking Crisis discussion

– Interest rate exposure – See Banking Crisis Over discussion

– Exposure to the US Dollar which is a fiat-currency (nothing backing it) – See Break-Away Bridges discussion

Prophetic words about the US Banking / Financial System

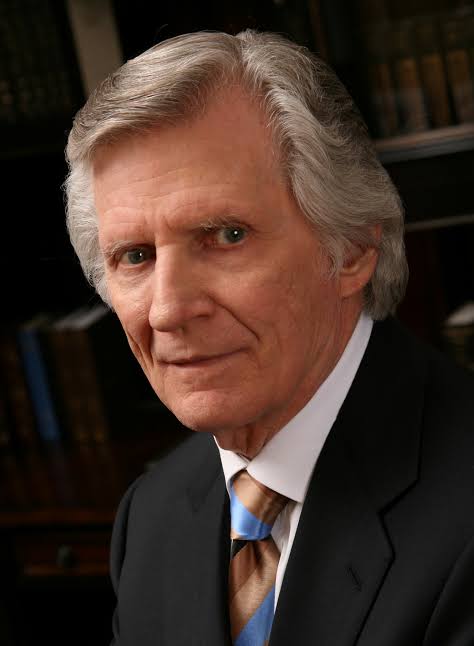

David Wilkerson’s “Bank Holiday” Prophecy

David Wilkerson’s “America’s Last Call” book

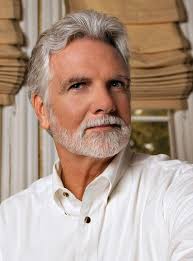

John Paul Jackson’s Coming Perfect Storm prophecy

JPJ Prophetic Headlines – “Too Big to Fail Fails” – B of A Nationalized; “Funds will Dry Up” – US Govt / Fed

Rick Joyner / Bob Jones Economic Earthquake Prophecy

Bob Jones Perfect Storm

John Mulinde – The Foundations Have Been Broken

What’s the answer? How do we prepare?

Why don’t we just create a Christian Bank or Credit Union?

Not your usual “bank”

Here is an AI generated summary of our website that I thought was actually pretty good:

Storehouse: A Christian Community Economic Network

- The Storehouse vision aims to create local Christian communities that facilitate economic relationships based on biblical principles.

- It involves forming a “Storehouse Community” where members exchange goods and services, support each other, and invest in local businesses, reducing reliance on traditional banks and financial markets.

- The community promotes “in-sourcing” by encouraging local production and exchange, and establishes a “savings club” to lend to those in need and support Kingdom initiatives.

- Coming out of Babylon and divorcing Baal are seen as forms of repentance, freeing individuals from cultural distractions and temptations that hinder Kingdom principles.

- The Storehouse Community acts as a “bank” for its members, providing non-recourse, no-interest loans to help people in financial need and promote economic productivity.